The biggest loser in volumes out of all the companies, the automaker which saw only the darker side of the market; Tata Motors suffered a very severe blow in the recent years. The figures could do nothing but haunt the company forcing it to adapt new strategies and thanks to that, today we have the Zest and the Revotron engine around us. Now coming to the figures; in 2011 the home side automaker sold 2,96,698 units with market share of 12.33 percent. In 2012 the sales slipped down by just 2.2 percent, but the market share had an impact and settled down at 11 percent. The company then saw a nightmare last year with sales dropping by 51 percent (YoY) and the market share sunk further to 5.9 percent. According to current sales, the company sold 59,633 units with a market share of 4.7 percent. Tata Motors expects to improve its numbers with the launch of the Zest and Bolt hitting the showrooms soon.

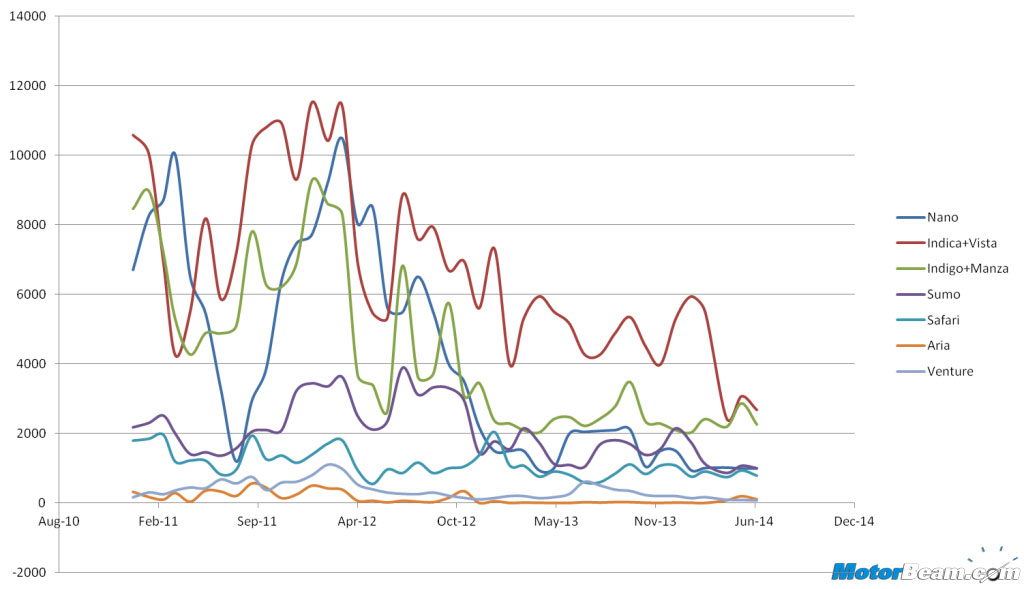

Nano – Starting with once upon a time “world’s cheapest car”, the vehicle never lived up to expectation. Often compared with auto-rickshaws, things went terrible with its Singur plant being shut down and since then things never looked fine. The sales chart has reported quite instability for a span of almost two years. In March 2012, the vehicle crossed the 10,000 marker just once which has been its highest in the recent past. Since January 2013, the chart looks to have settled with volume loitering around the 1500 line. In 2014 the company did revive it with the ‘Twist’ version but that didn’t help much as 6498 units have been reported to be sold.

Indica + Vista – The country’s first indigenously developed car was introduced in the market 16 years ago and the vehicle has yielded good volume for Tata Motors. The once upon a time segment leader lost the Indian glory as Japanese cars overtook it quite easily; the biggest mistake by Tata Motors of not pouring in efficient products in the past. The figures indicate that though the car went on to draw violent curves on the sales charts, in the end, the sales chart bit the bullet. In January 2012, 11,534 units was the maximum volume traded while the lowest was traced down to 2438 units in April 2014. This year 24,926 units were sold while during the same time period in 2011, 45,507 machines were vended.

Indigo + Manza – The Indigo – Manza combo still has a good chunk of Tata sales but just like the Indica/Vista the sedans could not withstand market erosion. The combo opened up with 8500 units in January 2011 but in a span of 4 months the sales fell by 50 percent. The second half proved to be handy as sales gained momentum and a threshold was registered in January 2012 with 9272 units. By December, the sales collapsed to 3500 units and since then it has been averaging at 3000 units per month. In 2012, the car saw a 19 percent drop in sales while the previous year was a nightmare with sales dropping by 54 percent. 2014 counted 13,842 units, not impressive at all.

Sumo – The Indian panda has been a key vehicle in the commuting world and unfortunately even this model has not been performing well. The Grande version of the Sumo didn’t work out as this utility vehicle performed much below expectations. The sales though haven’t been too wavery but the chart does indicate that the vehicle has seen ups and downs just like any other Tata and ended up being stagnant. In 2011 the vehicle averaged to 2000 units; in 2012 the market rose approximately by 50 percent as the average sales were 3000 units. The sales then followed the opposite side as demand fell by 50 percent with the count at just 1500 units per month. This year the figure went down further by 10 percent as average sales for the first six months stood at 1350 units with 8012 units on the chart.

Safari – The only market where Tata Motors is contesting for the top position is the premium SUV segment. The Safari did try to Storm in the market with the “Storme” but just like the other facelifts, it didn’t work out for the Land Rover inspired model. The SUV sales in India have never been too amazing but the company made sure that the model just brought revenue with its price tag. The sales gradually dropped from four digits to three digits. The average in 2011 was 1400 units while this year it’s 870 units. The YoY drop in sales is 19% in 2012 and 15% in 2013; not bad for a vehicle that has been surviving in the industry for a very long time. The Ladakh edition of the Storme should get them some numbers. Why is Tata hiding that beast under their garage?

Aria – The Aria was a very ambitious project and the company expected it to change the premium MPV segment but things never went as planned. The Aria in fact proved out to be a disastrous product for Tata as the engine lacked the punch required for its build. However Tata did upgrade the Aria to a more powerful engine with a few add-ons but it was too late to make another impression. In the last three and half years, the vehicle crossed the 500 units mark just once, while the sales crossed 100 units (per month) just twice and that too it was reported this year. In 2013, just 189 units were sold while this year the demand increased, as sales tallied to 404 units.