We at MotorBeam always try to enrich our readers with latest trends and updates of Automobile world. At the same time we try to provide you facts and figures which provide clear understanding of the market. Since February, this year, we started with sales figures and analysis of car industry of India. Now we are attempting to provide you the most awaited two wheeler sales figures and analysis. We will start off with analysis of two wheeler sales for first quarter of financial year 2012-2013.

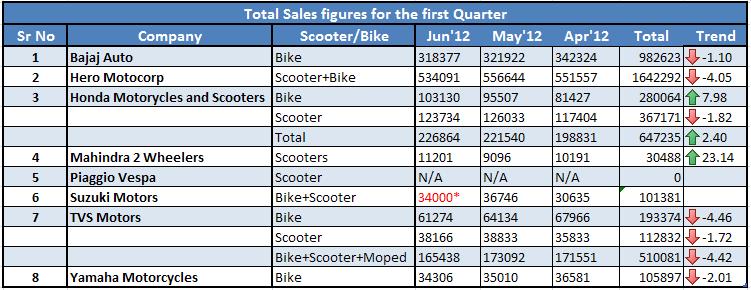

There are 7 major manufacturers in Indian two-wheeler market and Vespa is the newest entrant, being the 8th one. Out of it, if we look at the Bajaj sales, they are declining continuously since April 2012. Reason might be that consumers are holding their buying decision till Pulsar 200 NS and Discover 125 ST becomes available pan India. Also it’s a general trend that from June to Sep sales slows down a little as many wait till festive season to buy their set of wheels at a good deal. Total sales of Bajaj auto stood at 318377 units for June 2012. Same is the case with Hero Motocorp. Sales figures are declining in trend with overall sales standing at 5,34,091 units in June. But the momentum of Honda Motorcycles and Scooters India (HMSI) is not bothered about these things as their sales graph continues to grow by margins. The products that might be behind in this situation are refreshed Dio and new entrant Dream Yuga commuter. There is slight decline in scooters demand but Dream Yuga gave wings to bike sales for Honda, giving total sales figure of 2,26,864 units.

After acquiring Kinetic, Mahindra and Mahindra has taken two wheeler business very seriously. With current product lineup of 3 scooters namely Duro DZ, Flyte and Rodeo RZ (while Rodeo RZ unveiled recently, not on sale yet pan India), Mahindra has managed decent numbers of 11201 for June 2012 with Duro DZ being the big seller. Mahindra recently announced about 3 bikes being launched this year and Duro micro hybrid in the pipeline, so the trend might see an upward direction.

The newest entrant Piaggio Vespa with its LX-125 has not revealed their sales figures. But we don’t expect it to be big in numbers as this scooter is placed as a premium offering with premium price tag. Suzuki Motorcycles India is also betting big in Indian two wheeler arena, with two new products launched already and the Dabanng actor endorsing it. They have not revealed the figures for June yet but it is expected to be around 34,000 mark making quarterly figure of above 1 lakh units.

It appears that, very old player TVS has lost its grip and is losing its market share day by day. Especially the bike market is reflecting the continuous downwards trend for them. TVS managed to sell 165,438 units in June 2012. New RTR series has been launched recently which may reflect in next month’s figures. Yamaha on the other side has revealed their sales figures for May and June together as 69,316 units, taking their quarterly figure over the 1 lakh mark. Impressive figures indeed from Yamaha considering Yamaha has not yet focused on entry level commuter motorcycle and scooter market. If that happens Yamaha volumes will churn big volumes compared to current numbers.

*Note: Suzuki has not released sales figures for June’12, thus 34,000 is the projected figure looking at current trend and past performance of Suzuki. Actual figures may vary.

Yamaha released combined figure for May and June as 69,316 units, the split is 35,010 and 34,306 for May and June respectively for further illustration.

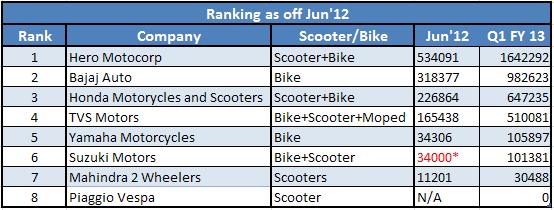

The following table shows the current standings of two wheeler manufacturers in India for the month of June and also for the First Quarter of FY’13. The Hero Motocorp is leading the market and by a big margin. The difference is too big to cope up with, for any manufacturer in short span. With proven products and many people having faith in brand, it is quite a difficult task for others to take the Hero’s number one position anytime soon.

With close to million units sold in the quarter, Bajaj stands at number 2. With Pulsar 200NS and Discover 125ST undergoing phased launch, Bajaj might see big jump in figures in next few months. After getting separated, HMSI has overtaken Bajaj for number two position in the month of March. But since then they are holding their position at number 3. TVS motors, being an established brand, is beaten by comparatively late comer HMSI and is at number 4 position. The reason may be lack of technology or unavailability of good products in portfolio. For TVS, except Apache and Scooty, no other product has proved itself. Also absence of good bike in entry level commuter segment and absence of a good product to take on scooters from Honda is what is hampering the TVS sales.

At number 5, Yamaha has sold 105,897 units in the last three months. With its strong presence in performance bike market alone, Yamaha is running neck to neck with Suzuki which has sold almost over 1 lakh units and is at number 6 position. (Suzuki’s figure for June has not been revealed yet and is projected on the basis of market trend and past performance of Suzuki). After restarting their innings, Mahindra is gaining pick up and is holding the second last position while Vespa holds the last spot.

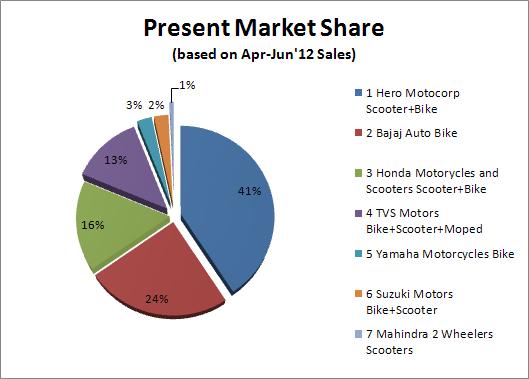

Following pie shows the market shares of individual companies. Top three companies holds more than 80% of market volume.

Hope this gives you a little idea of current scenario of Indian two-wheeler market. We will try and bring more detailed information next time. Your comments and suggestions are welcome on our first attempt.