The 2015 Union budget has been announced and we have a look at some significant points which will be affecting the auto industry in India.

Every year, we car enthusiasts look forward to the Union budget with great optimism. This year too the enthusiasm continued because the auto industry had given the government some recommendations on what changes should be made in the budget to favour the auto sector. So the budget has finally come out and the grass doesn’t seem to be very green for the automotive market. First up, many manufacturers were asking banks and other finance lending companies to reduce interest rates but this request has not been addressed and the interest rates will continue to be the same as before. A reduction in rates would have boosted many segments, especially the entry-level mass-market segments since these comprise of buyers who are on tight budgets.

On another note, the Government of India has promised to speed up the activation of the Goods and Services Tax and GST should come into force by April 2016. GST will boast of a consistent and uniform tax structure across all the states in the country and this will surely be a huge plus point. In the present scenario, some states like Bangalore and Mumbai have high taxes for registering new vehicles while certain other places like Jharkhand and Pondicherry have far, far lesser taxes. Due to this, buyers of luxury vehicles often register their vehicles out-of-state to save moolah and many times these registrations are coupled with corruption and reproduction of fake documents.

Coming back to the context, the previous government had provided reduction in excise duties charged over different segments of vehicles. With effect from 1st January 2015, these excise duties were hiked and hence the auto sector had asked the government to review this policy and if possible try to provide a concession in these duties once again. This request to cut down excise duties has also been put off by the ministry. Instead, the basic excise duty on small cars has been hiked minutely from 12.36% to 12.5%.

Moving to electric vehicles and hybrids, the ministry has waved off duties on EVs and hybrids. The budget also set aside Rs. 75 crores for the manufacturing of electric vehicles which is too less. At present, the Mahindra e2o is the only EV that is sold in India apart from some scooters that come from different Chinese makes (there is Hero Electric too). Since duties have also been waved off from hybrids, we are hoping to see some price cuts but that also seems highly improbable. The Toyota Prius, Camry and BMW i8 are the only hybrids sold in India.

For commercial vehicles, the customs duty has been increased from 10% to 40%. This is highly unlikely to affect that sector. As of now, 1 lakh kms of roads are undergoing construction in India and the government has stated that it will introduce new 1 lakh kms of tarmac. This huge increase in the number of roads will witness a huge boost in the demand for commercial vehicles.

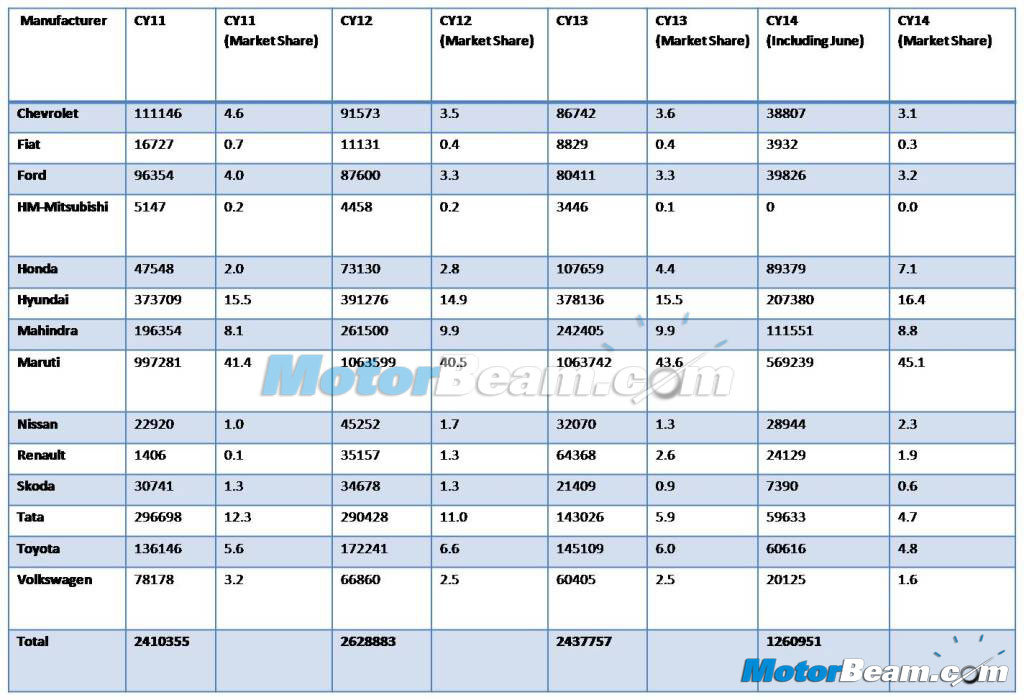

All in all, the 2015 budget doesn’t seem to be too favourable for the auto market. Most of the changes are aimed at long-term growth and development and there is hardly anything to look forward to in the near future, apart from the obvious GST. So, demand for new vehicles isn’t going to soar through the roof and the industry is likely to move forward this year in a similar fashion as the previous year.