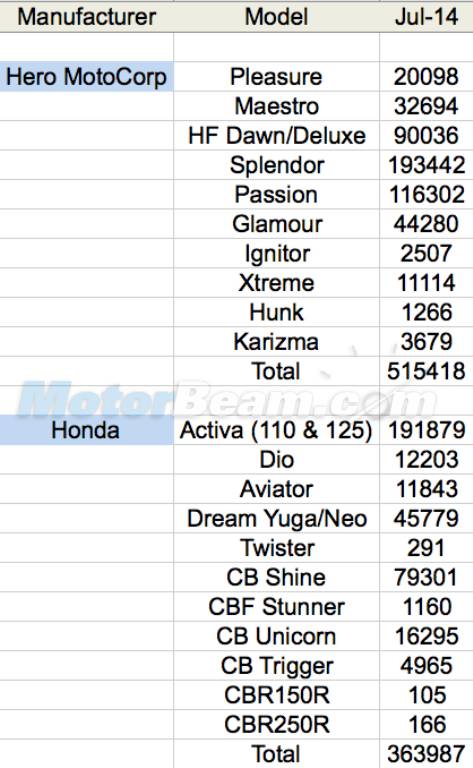

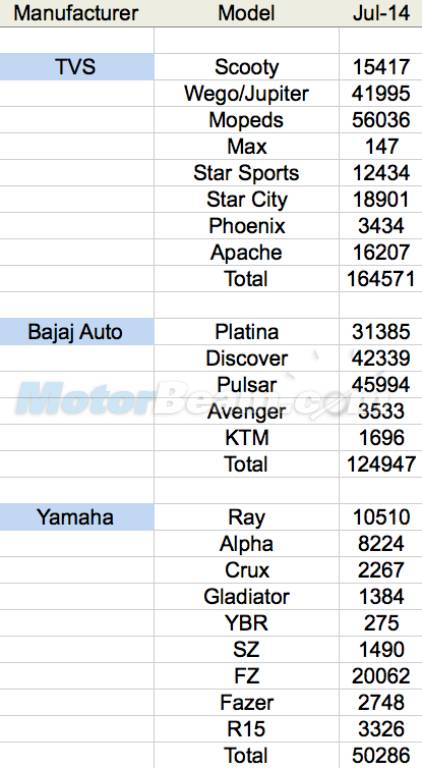

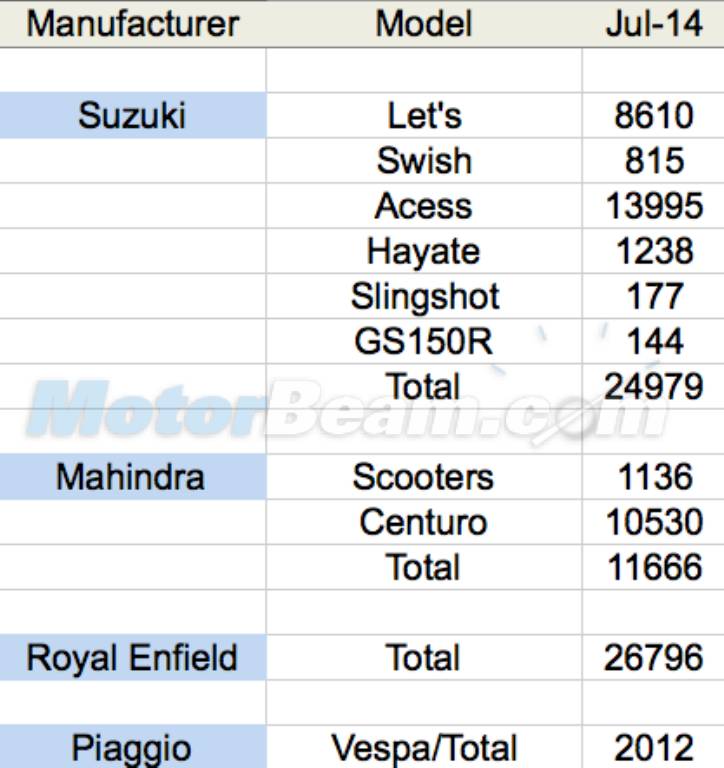

When it comes to mainstream manufacturers, everyone except the Japanese have seen a decline in sales in July 2014 when compared to June 2014. Yes, that’s true, right from Hero to Bajaj and TVS, Mahindra, all these companies saw their sales see a minor decrease while the Japanese trio consisting of Honda, Yamaha and Suzuki saw a minor increase in sales. While Hero’s minor decrease in sales can be attributed to a minor decrease in demand of the Passion, Bajaj Auto saw sales tumble due to a very minor decrease in Pulsar sales and a massive decline in Platina sales. TVS’ Star Sports was the result in sales decline for the Hosur based company while the Centuro was the reason for Mahindra.

In terms of the Japanese, Honda’s ever popular Activa saw a massive increase in sales, with 50% more sold in last month compared to June 2014. For Yamaha, all its products except the Alpha saw an increase in numbers while for Suzuki, the Let’s and Access covered up. Piaggio continues to sell around 2000 scooters every month while Royal Enfield has also been more or less consistent when it comes to domestic monthly sales. So what makes every manufacturer tick? Let’s find out.

Hero MotoCorp, the undisputed leader in the 2-wheeler market gets majority of its sales from the Splendor and Passion. While its erstwhile partner Honda solely relies on the Activa and Shine to bring in numbers. For Hero, even the HF Deluxe/Dawn are doing good numbers while in the premium segment, the Karizma is also doing quite well. Honda’s CBR series seems to be dud now, the 150R and 250R selling a combined 271 units which is very poor in comparison to the KTMs, the Duke 200 and Duke 390 managing a whooping 1696 units. This number will only swell with the arrival of the RCs next month.

Bajaj Auto hasn’t been doing well and TVS has overtaken and managed to maintain its lead in domestic 2-wheeler sales, largely thanks to mopeds and scooters. The Discover and Pulsar seem to have stagnated but will the new Discover 150 help Bajaj’s sales is something only time will tell. Meanwhile, the Apache and Star City continue to perform consistently for TVS but it’s clear, the scooters are bringing in the numbers for the Jupiter maker. The latest Scooty Zest should further strengthen TVS’ position in the market while the Victor is due for launch next quarter.

Yamaha’s majority sales continue to come from its 150cc bikes, the FZ being the top-seller while the scooters are also doing quite well. The R15 is also selling very well for its price but in the commuter segment, Yamaha simply can’t match Hero or Honda, the latter’s Dream series being the top selling motorcycles for Honda after the CB Shine. Suzuki too is extremely weak in motorcycles, selling less than 1500 units a month and solely relying on scooters for their bread and butter. The Gixxer should change things though.

So it’s clear, the volumes are in the entry-level commuter segment which is 100-110cc motorcycles and scooters. While Hero bets on motorcycles, Honda bets on scooters and Bajaj bets on creating new segments with 150cc commuters. Yamaha’s focus is on premium products, as so evident by the pricing of its 150cc bikes while TVS and continue to rely on scooters. It will be interesting to see how Honda’s CD110, Bajaj’s Discover 150, TVS’ Victor and Suzuki’s Gixxer perform in the market and whether they do any good for their respective manufacturers when it comes to sales volume.