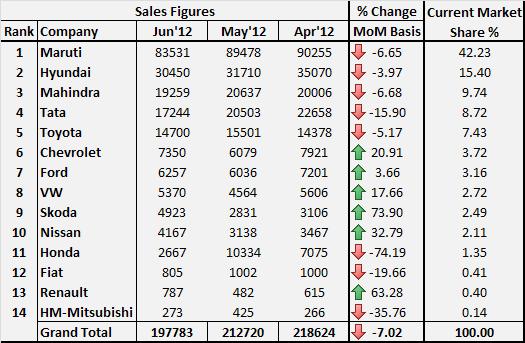

The Big Picture – The month of June came out with surprises and many ups and downs. With increase in petrol prices, car sales were anticipated to go down drastically at least for June. It happened but the severity of it was dampened by diesels. Thus, rise in petrol prices has not restricted many Indian minds from buying their own set of four wheels. It was also seen that there was some rise in demand for specific small petrol cars. Some gained by big margins and some lost the same way which is quite strange. We will get into details later. Thus, the month of June was a mixed bag and stood at 197783 units with 7.02% fall in volumes.

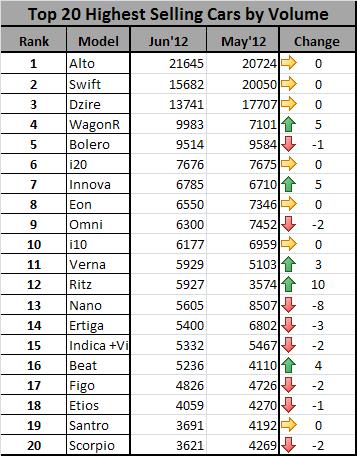

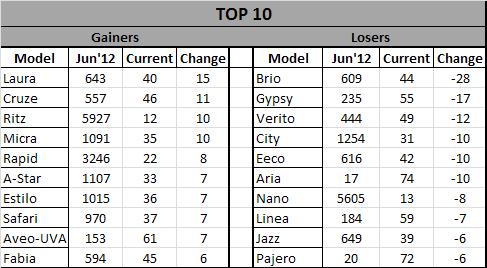

The top 20 highest selling cars by volume will reveal that loss for some resulted in gain for others. Nano’s reduced volumes, consistently falling Indica figures, loss in volume of Ertiga due to technical issues gave their places to Innova, Beat, Ritz etc. Alto, the hot seller gained some volumes once again and drop in Swift figures resulted in Alto comfortably enjoying the top spot. Drop in sales volume of Swift, Dzire came as a result of scheduled weeklong stoppage at MSIL. The case with Tata seem to be getting worse day by day, as Nano and Indica range lost once again badly, throwing them out of the Top 10 sellers list. Once we thought that the loss in Tata volumes may be due to some technical issues at manufacturing unit but now seeing continuous fall in sales for last 3-4 months, it appears that Tata brand appeal has gone down in consumers mind. Another highlight is the Brio, provided that it was doing pretty good, vanished from Top 20 list. The numbers of Brio were horrible at mere 609 units.

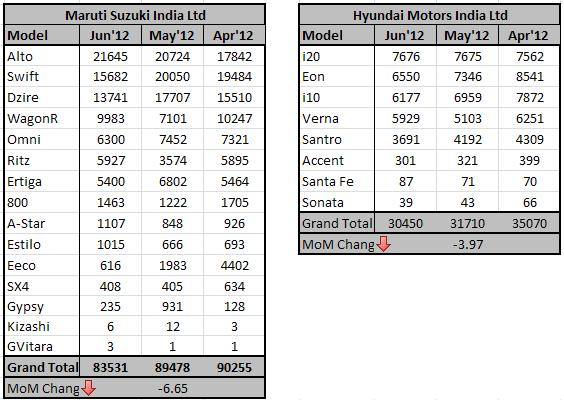

Company-wise Break Up – The Top 2 sellers in India are showing some negativity in June sales figures with Maruti losing 6.65% and Hyundai losing almost 4% of their sales volumes. The week long stoppage scheduled for maintenance activity hampered the Swift, Dzire and Ertiga numbers directly. However its effect was nullified by sending out excess stock of the WagonR, Ritz, etc. A-star and Estilo have crossed 1,000 mark once again, the discounts and promotional offers seem to have worked for them. Hyundai is once again having i20 on top of their charts. With all petrol cars losing by slight margin and 2 hot diesels gaining a little, the Hyundai is in satisfactory situation.

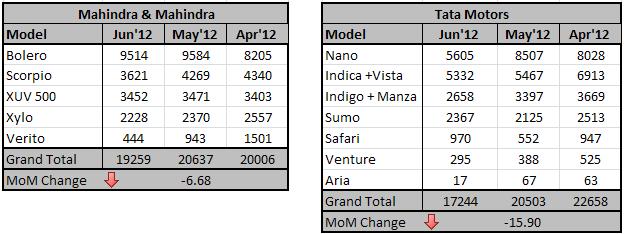

Following tables shows the sales figures of prime diesel makers from India. Where Mahindra has lost just 6.58%, Tata has lost by big margin of 15.9%. The situation with Tata is becoming worse day by day. Tata, the company which was selling more than 36,000 cars a month in March, is now down by 53% to just above 17,000 mark. Even after losing 3,000 units, Nano is still a top seller for Tata. Discounts of Rs.40,000 to Rs. 70,000 failed to get Indica, Indigo range going. The premium offering from Tata, The Aria has sold just 17 units. A situation has arrived where Tata either has to pull the plug (which is not expected) or has to cut the prices heavily.

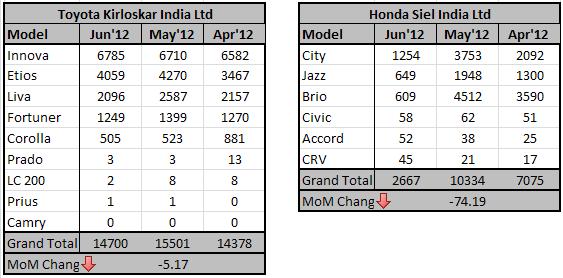

Japanese duo, Toyota and Honda, has recorded 5.17% and whopping 74.19% loss in sales respectively. The story is going on the usual lines according to overall picture of Indian auto market for Toyota. But Honda picture has turned completely upside down. With Jazz and City losing 2/3rd volume as compared to the last month, the customers failed to love back Brio this months as it sold just 609 units. And as Honda’s bread and butter, Brio is not doing well, the results are quite obvious.

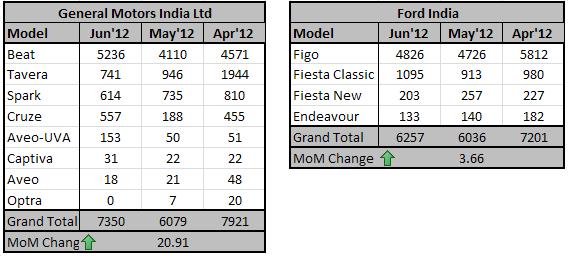

The companies that gained volumes this month mainly achieved on the basis of their diesel offerings. Look at the following tables and the scenario becomes clear immediately. The Beat from GM and Figo from Ford drove the sales upwards. Mainly 1-ltr diesel idea is powering the GM sales as of now. While performance of Cruze is also commendable, this is expected to improve further in July.

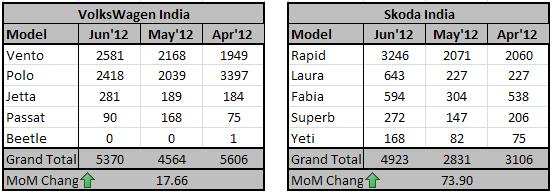

Look here and the story speaks out louder in the language of diesel. Volkswagen and Skoda showed the upward trend with 17.66% and 73.9% growth respectively. 3,246 units of Rapid were sold, which is a huge gain in volumes, but at the same time the entry level offering from Skoda is not gaining the momentum and still doing small numbers.

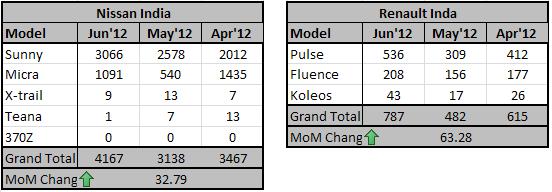

The Nissan and Renault are now getting into a higher gear as both recorded strong growth over the last month, 32.79% and 63.28% respectively. The 1.5-litre diesel motor did its job. Wait for the next month’s figures for Renault and it will be the highest ever rise in sales for Renault India, the reason we all know is the just launched Duster.

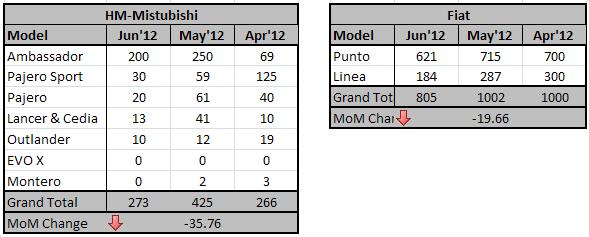

Always at the bottom of the chart, HM and Fiat showed negative trend and no one seems to bother about it. HM has lost 35.76% and Fiat has lost 19.66% sales compared to the last month. As there is no new product being offered by Fiat this year, the figures are expected to hover around 1,000 mark in total except during the festive season if they come up with good festive offers. Pajero Sport sales, after the initial wave, has fallen down continuously by 50% every time. Out of the 273 units sold by HM, 200 came from age old Ambassador. The management at both the companies can be interpreted only by the God, it seems.

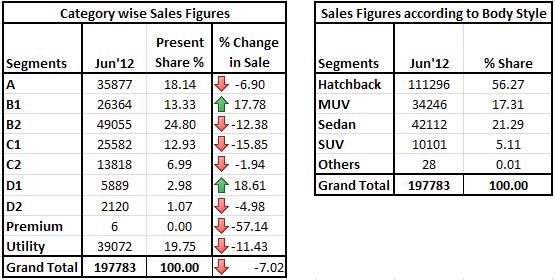

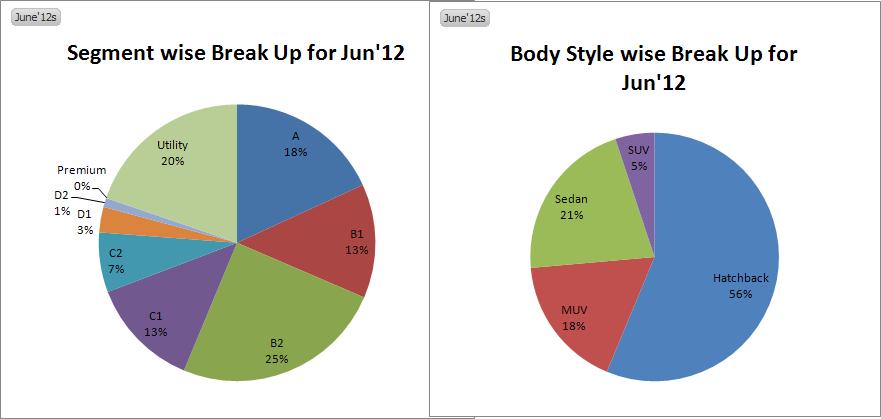

Category and Body style wise breakup – Following table shows the breakup of sales according to category and body style. Where each category has lost volumes, the small cars have gained and that is because of the petrol hatchbacks like WagonR, A-star and diesel hatchback Beat. The D1 segment growth is not so big in terms of volumes but is commendable. The new Cruze and Jetta are one of the main contributors.

Gainers vs Losers

Things To Look For –

- Renault Duster launched.

- Petrol prices revised, will it pump in sales of petrol cars?

- Monsoon heading in will slow down the market overall.

- Crude prices falling continuously, will it reflect on fuel prices in India?

- Dollar prices, will it stabilize?