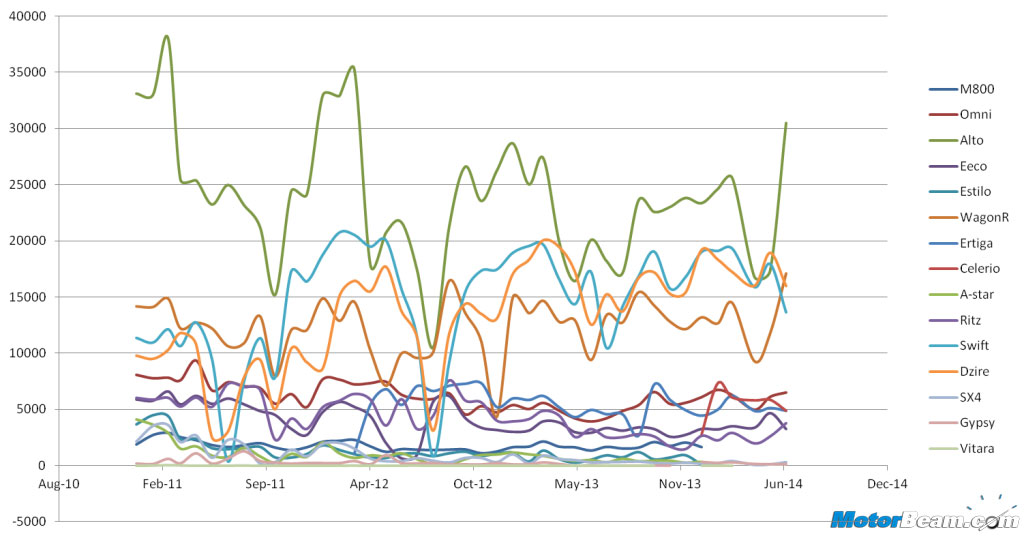

The company which has held the iron throne for many years and which probably would hold its position in years to come, though did not perform exceptionally well but was at par when compared to the mass market in which it operates. The leader in sales of the Indian sub Rs. 10 lakh automobile market has retained its market share with 41.4 percent in 2011; however, lost 0.9 percent market share in 2012. Though the company posted almost the same numbers in 2013 as it did in 2012, it gained 3.1 percent (YOY). According to current sales, the Japanese maker owns 45.1 percent of market share. During these three and half years, the company permanently halted production for give cars with the Celerio putting an end to the Estilo and A-Star; whereas the country’s first hatchback Maruti 800 bid farewell after serving the countrymen for 31 years. The last dusk at the production line ended up at 26.6 lakh units. The Kizashi proved to be a perfect recipe for disaster and taught a lesson to the Indo-Japanese combo that the premium segment isn’t their cup of tea. The SX4 has also stopped production, making way for the new Ciaz to take its place.

Omni- 30 years into the industry and the car is still selling in decent numbers; in fact the figures are far better than many other cars in the market. Though demand has been up and down, 6000 units of the utility vehicle are sold every month. If asked any Indian, everyone would choose Omni for their utility purpose; that’s simply because the vehicle has become an integral part of the population.

Alto – The Alto has a habit of breaking milestones. We would rather say set milestones for itself to break. Since 2011, this entry-level hatch has been selling with an average of 24,000 units per month. The highest recorded sales per month during the three and half years session was March 2011 when 38,065 Altos were traded and the lowest being 10,488 in August 2012. The sales totalled to a seven digit number; mathematically it is 10,02,125 units only. The Alto has plenty of so called competitors in the market but practically it has only two.

Eeco – Eeco, the sibling of Omni hasn’t been impressive as the latter one. The Eeco sells with an average number of 4000 units a month and could not surpass Omni’s sales even once in the recent past. Even though not a good sign for Maruti but the company wouldn’t mind as long as it holds the market share in the segment. The vehicle sells in comparatively lesser numbers and tallied at 21,205 units for the first six months when compared to early 2011 (35,430 units from Jan-Jun). This car will be there in the market as long as it satisfies the number game.

Wagon R – This Japanese wagon hasn’t displaced much from its base margin of 12,500 units per month as the vehicle has been selling at a standard pace. Though the sales took a leap a handful of times, the car managed to climb up the ladder and maintain its pace. The Stingray version was expected to boost sales but that really didn’t happen; one of the few times where the Japanese read the market wrong. We have nothing to praise or criticise about a car that has been standard in the market for quite some time now.

Ertiga – The ambitious MPV has been praised as well as criticised in the auto community but one has to admit hands down that the company placed it in a very sweet spot. Marketed as ‘Life Utility Vehicle’, the demand was good for the first year as sales averaged 6000 units per month. Later the average went down by 1000 and settled at 5000 units. This year 30,487 units of Eritga have been sold. We expect the sales of this car to go down further, once the Honda Mobilio gains momentum.

Celerio – The lifeline for automatic transmissions in the country, this car equipped with Magneti Marelli’s AMT (Automated Manual Transmission) has set a new course for the automobile industry. A super combo of fuel economy, comfort of an automatic transmission and affordable for a common man; certainly has won millions of hearts. The congestions in the cities and demand from the customers led this technology to the mass market where only 5-7 percent of the cars are automatic; most of them being SUVs. Though overhyped prior to its launch, the car did have its disadvantage but still very much in the acceptable levels of fellow Indians. Currently the AMT units are being imported from Italy because of which the automaker is failing to meet customer demands. Running on full capacity, the Celerio is yet to quench the thirst of the sub-continent’s population. 33,684 units of Celerio have hit the streets so far.

Ritz – The Ritz has been spotted sliding down the sales curve. In the initial days of 2011, the car was selling at 6000 odd units per month but since early 2013, the descent steepened as sales fell to 4000 units a month. The second half of 2013 dragged down the sales further and currently the Ritz has been trading at somewhere at 2000 units a month. The least reported sales were in December 2013 with 1478 units, while the highest in the recent past was in September 2012 with 7598 units. Maruti has to come up with some revival plans for the Ritz in India, even though the model has been replaced by the Celerio internationally.

Swift – The Swift has been in the market for almost a decade and it did play a crucial role for Maruti in holding its market share. The sales did see ups and downs, frankly speaking very violent trends during January 2011 and October 2012 but since then the car did settle for an impressive mark of 15,000 units per month. Revival with facelifts and petrol engine propelled the sales and one hardly has got anything to complain against this ultra hit hatch. You are the king in the premium segment hatch and seem difficult to beat.

Swift DZire – The only sedan rather a compact one to occupy the throne probably since the 90’s, the DZire managed to be the top seller in the country for 3 months (once in last year and twice in the current year). Earlier in 2011, the car used to sell at 10,000 units a month but since January 2013 the production went on full throttle as demands almost doubled. 20,078 units in March 2012 was the peak and this is the only eligible car to fight for the numero uno position. This year 1,05,773 units have already been dispatched by the dealers. The DZire has certainly fulfilled the desires of many Indians.

SX4 – The car never managed to pull the crowd towards it. People criticised Maruti for not launching a diesel version but when the company did, they turned it down. The SX4’s sales degraded month by month and finally the automaker pulled the plug on this sedan. This year only 1349 units have been sold. Nonetheless, the SX4 is being replaced by the Ciaz sedan in the coming weeks.

Gypsy – Still the heartbeat for many Indians, the Gypsy unfortunately lies at the bottom of the table with feeble sales. Though people like it a lot, it has not been a practical vehicle anymore. One should not be shocked if the company pulls out this utility vehicle off its portfolio sighting poor volumes. The country saw 1273 units of the Gypsy hitting the streets.

Grand Vitara – Just a couple of questions we want to ask the Maruti management. Why is it still there in the market? What do you want to prove with the Vitara still being showcased as a product? No Indian is foolish to pay a quarter of a crore Indian rupees for welded sheet metal. Not even one unit has been sold this year.