Government of India reduces customs duty on high-end bikes (imported as CBUs) to 50 percent, CKD rates reduced by 5 percent.

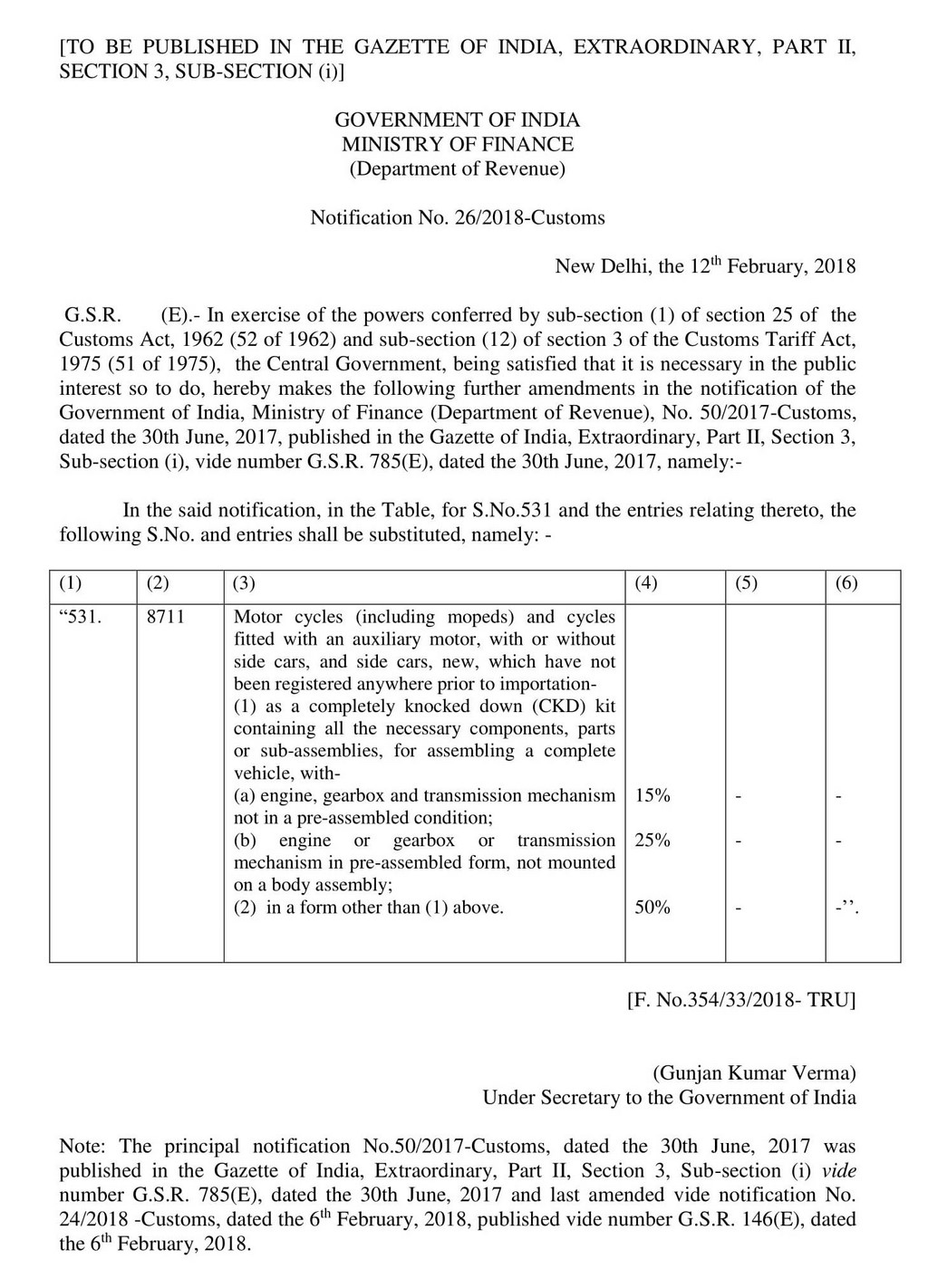

A good news indeed for all the motorcycle enthusiasts out there. Government of India has reduced the customs duty on imported motorcycles from brands like Harley-Davidson, Indian Motorcycles, Triumph and others to 50 percent. Previously, import of bikes with an engine capacity up to 800cc or less was taxed at 60 percent while those with capacity of 800cc or above attracted a duty of 75 percent. The Central Board of Excise and Customs, through a notification dated 12th February 2018, has slashed the duty on both the variants of bikes to 50 percent.

CKDs (completely knocked down) also see a minor rate cut. Customs duty on CKD kits in “pre-assembled form” of motorcycles not mounted on a body assembly has been reduced to 25 percent. The previous rate was 30 percent. Meanwhile, to promote the ‘Make in India’ campaign, CBEC has also increased the customs duty to 15 percent on import of engine, gearbox and transmission mechanism as a CKU kit which is “not pre-assembled”. The duty on these was 10 percent earlier.

Customs Duty On High End Bikes

– CBEC slashes customs duty on CBU import of bikes to 50%

– Same duty applicable for above 800cc and below 800cc bikes

– CKD kits in pre-assembled form of bikes, not mounted on body assembly taxed at 25 percent