The Quest For Market Share In India

We see how Hyundai is trying to catch up to Maruti Suzuki.

We see how Hyundai is trying to catch up to Maruti Suzuki.

Home » General News » The Quest For Market Share In India

Recently, Kia revealed the Sonet. The car has nearly all the unique features the Seltos debuted with. One reader pointed out how this could cannibalise the sales of the Seltos after this car gets launched. I had written an article covering a very similar situation, when the Venue was launched alongside the Creta.

Now, when I wrote that article, I was in the mindset that Hyundai will shoot themselves in the foot with the Venue’s positioning. However, thinking about it from the perspective of market share, the situation makes a lot more sense.

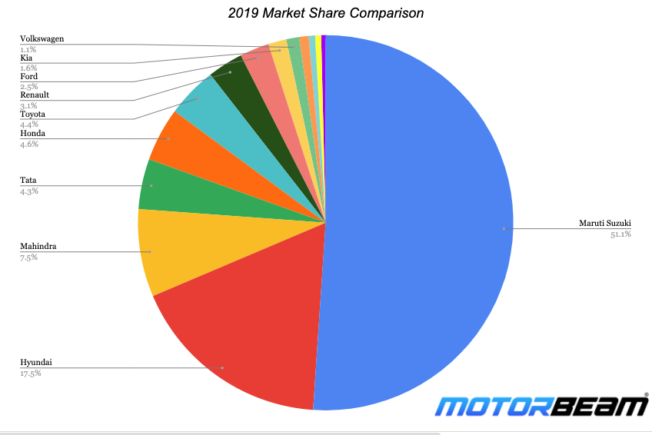

The automotive industry in India is very much dominated by Maruti Suzuki, when it comes to market share it holds. Maruti sold nearly 15 lakh cars last year! For comparison, Hyundai, its nearest competition sold ‘only’ 5 lakh cars.

Last year was considered pretty bad, when it came to the overall landscape of the industry (little did we know about 2020). Even for a ‘bad’ year, Maruti still managed to sell nearly 3x the cars its nearest rival sold.

This puts Maruti in a pretty powerful position. Word of mouth plays as much as a big role as the product itself in our market. When Maruti is able to reach much more customers than others are able to, they can create a snowball effect of sales. Families literally buy a model from a brand just because their relatives are happy with that particular model.

Now, obviously this is due to Maruti’s merit and proper research as well as building on their own strengths. However, the advantage that they hold also means that some solid offerings from other companies simply get overshadowed.

How many times have we praised a new car from another brand, only to scramble for excuses to explain why it’s not selling well a few months later? Most of the time the reason is simply down to consumers not willing to jump ship. Many take the safe route, and go for the car everyone has.

A Large Customer Base May Always Not Be Good

The only problem with Maruti vehicles, seems to be that they are not for the younger audience. You can’t expect the company to just come up with some radical design, and expect to sell the same they do now. So, their designs come out to be more conservative more often than not.

The best they can do without upsetting the balance is throw in some diamond cut alloy wheels, and smoked headlamps, that too in the top-end variant. It’s not like they haven’t tried, the Ignis was not received well (relatively), nor was the Baleno RS.

Not just the design, but the feature set is also not class leading. It is good, and just works. Maruti came up with NEXA when they realised selling a Rs. 3 lakh car, and a Rs. 15 lakh one under the same roof doesn’t work too well.

Hyundai’s Approach

Hyundai finds itself in second position when it comes to market share, but is quite a long way off Maruti. They are in a pretty stable second, but are working towards closing the gap.

Now Hyundai’s approach to getting more market share is a bit more comprehensive than the competition. So, I will be focusing on it. With Kia’s launch in India, the Hyundai group gets to try out 2 different variations of the same platform, where demand is high.

SUVs sell the most in our country right now, and hence it makes financial sense to develop two variations. Which is probably why Kia is deciding against launching hatchbacks in India for now. The launch of the Kia Carnival also shows that Kia aims to have a separate identity, and not just make a 2nd version of whatever its parent company makes.

Of course, this situation is present in the other markets for a long time, and with other brands as well. In the US, we have Acura, owned by Honda, Infiniti, owned by Nissan, etc. If this becomes a success in India, and Kia manages to establish the same trust and share amongst the customers, then Hyundai might be on to something.

They are willing to be a bit more experimental in their approach as it seems. The introduction of iMT is another example of this. This is certainly more welcome than the sometimes drab approach we are used to seeing.

If the gap closes up, we might have a more neutral scenario, where the car does the talking, and the brand less so. This is an extremely ideal situation, especially when we are talking about big money. Overall it is always good that the field remains close, as it would keep each brand honest, and it would mean we would get the best value in every segment.