Nissan though present in various segments hasn’t capitalised on the opportunity. One of the major reasons was the failure to increase the number of dealerships. This Japanese car maker hasn’t influenced the auto industry much as it contributes only a small percentage to the domestic market. In 2011 the company had a market of just 1 percent; while in 2012 sales doubled and the market share improved to 1.7 percent. In 2013 the company lost momentum as sales fell by 30% and adjusted itself to a share of 1.3 percent. During the past years the company called off the premium segment as they stopped sales of the X-Trail and 370Z models. But during the same course the company did introduce 4 new models belonging to various segments; out of which proved out to be a decent selling model. Currently this year the company improved its share to 2.3%.

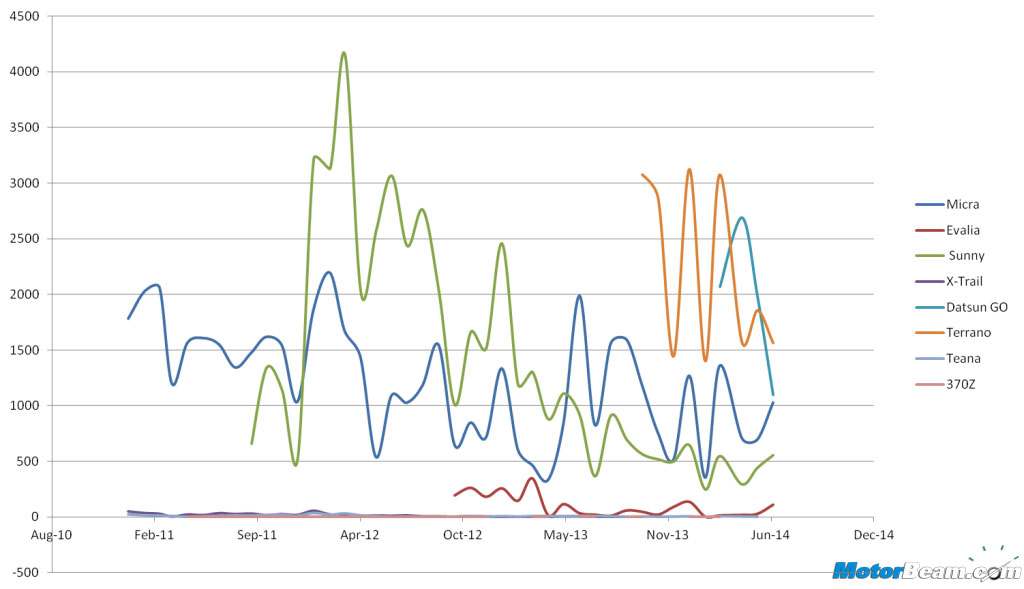

Micra – The hatch developed as a part of the Renault-Nissan joint venture couldn’t do much in the high volume environment. Averaging 1200 units per month for the past three and half years, the Micra has only been a micro part of the premium hatchback segment. The peak can be traced back to a couple of years with 2198 units in February 2012, while the valley was reported last year in April with 335 units; just 2% of Swift sales. 5422 units is the tallied figure for this calendar year.

Evalia – A horizontally laid refrigerator is what we could think off. Failed to make its presence in the market, the Evalia could not evolve. It has been almost two years since the Evalia was launched and the company couldn’t sell even 2500 units till date. This utility vehicle has been averaging just 100 units per month. Poor market study coupled with lack of design led to this dreadful figure. Surprisingly, the Evalia is one of the most successful models for Nissan internationally and it’s a very practical car.

Sunny – The top notch in the sales chart for almost one and half years for Nissan, the ‘Caaaar’ has not been doing well either. Though the company recently launched the facelift, it could not lift the sales chart. Criticised for plenty of parameters in the segment where this sedan couldn’t actually connect with the Indian customers. The car could cross the 4000 units mark just once and the sales have averaged to 1400 units a month. This year just 2734 units of the Sunny have been sold. Nissan however, has promised a restructuring of its strategy for India in the coming years.

Datsun GO – To compete in the entry level hatchback segment, the automaker did play a very good card but the response from the customers hasn’t been great. Though the car has potential to beat out every other rival in its segment, the GO failed purely because of poor dealership network. The company has been selling the GO hatchback via Nissan dealerships but later plans to separate Datsun from Nissan. Four months into the market and the company managed to sell 7847 units. It is still not too late to take corrective actions and trade it at higher volumes.

Terrano – The last badged baby of the Renault-Nissan alliance, the Terrano is the premium version of the Duster. Though it is seriously not on the premium side but yes the remodelled version did make it look better than the Duster. The Terrano was never in direct competition with the Duster because of the price tag; the demand had been fluctuating with sales averaging to 2200 units. 19,995 units of the Terrano have been through RTO office registrations across the country since launch.