India’s electric two-wheeler market reshapes in 2025, legacy brands gain ground

India’s electric two-wheeler market underwent a notable shift in 2025, with the competitive landscape changing significantly from the previous year. While overall demand for electric scooters and motorcycles continued to grow, the leadership table saw a reshuffle as legacy manufacturers strengthened their positions.

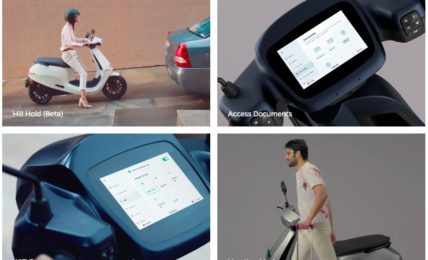

After dominating the segment in 2024, Ola Electric experienced a sharp decline in market share during 2025. Its share dropped from 36.7 percent last year to 16.1 percent, with annual sales of 1,96,767 units. This came despite improving retail momentum across the electric two-wheeler category, as reflected in registration data from the government-operated Vahan portal.

In contrast, established two-wheeler manufacturers made steady gains. TVS Motor emerged as the new market leader, capturing a 24.2 percent share on the back of sales totalling 2,95,315 units. Bajaj Auto followed closely with a 21.9 percent market share, underscoring the growing influence of traditional players in the electric space.

Industry observers attribute this realignment to multiple factors. Legacy manufacturers have increasingly leveraged their extensive dealer networks, established service infrastructure, and wider product portfolios to win customer confidence. As competition intensifies, these advantages are beginning to play a larger role in purchase decisions, especially beyond early adopters.

The year also proved challenging for several electric vehicle makers due to external pressures. Supply chain disruptions linked to constrained availability of heavy rare earth metals, influenced by geopolitical developments involving China, added to cost pressures and operational complexity across the industry.

Meanwhile, newer EV-focused brands also made notable progress. Ather Energy strengthened its position by expanding into the mass-market segment with the Rizta electric scooter. This helped the company increase its market share to 16.2 percent in 2025, up from 11.3 percent a year earlier. Hero MotoCorp also recorded meaningful growth, more than doubling its share to 8.8 percent, driven by rising acceptance of its Vida electric range.

The latter part of the year saw the shift become more pronounced, as customer focus increasingly moved towards reliability, service reach, and consistent delivery experiences. Analysts note that competition is expected to intensify further, not only in electric scooters but also in electric motorcycles, as incumbent manufacturers scale up their offerings and investments.